Global Automotive NFC Market worth $6bn by 2025

Published Date: May 2019

Automotive NFC Market size is set to exceed USD 6 billion by 2025; according to a new research report by Global Market Insights Inc.

In this digital era, connected automotive has emerged as the next major change impacting the automobile ecosystem. The drivers are expecting their vehicles to be a digital extension of their lifestyle. The customers want their automotive systems to be customized as per their specific needs. The drivers are no longer considering cars as just a mode of transportation used for shopping and commuting to office places. The passenger cars are being viewed as a method to guide them to their required destinations, spot & report issues on the road, and provide parking assistance. The drivers are willing to embrace the paradigm shift in the automotive industry by seeking more advanced & personalized solutions, better suited for their driving needs and promoting the use of NFC solutions in automobiles.

Technological advancements in the connected car landscape coupled with the ever-rising need for saving time and maximizing productivity are driving the penetration of IoT technology in the automotive market. The cars are being incorporated with IoT applications such as in-vehicle infotainment systems, predictive maintenance systems, and dashboard reporting. The introduction of these next-gen IoT systems in automobiles has been promoting the use of high-speed communication technologies that can offer faster data rates, response times, and secure vehicular communication. The NFC technology establishes a safe & secure communication channel when transferring data among the automotive components while preventing any unauthorized access from external sources. Another factor that has acted as a catalyst for the adoption of the technology over its contemporary peers, such as Bluetooth and Wi-Fi, is its faster connection establishment and response times. The automakers are leveraging on this attribute to provide simple “tap and go” functionality for features, such as car access and engine ignition, further supplementing the growth of the automotive NFC market.

Get more details on this report - Request Free Sample PDF

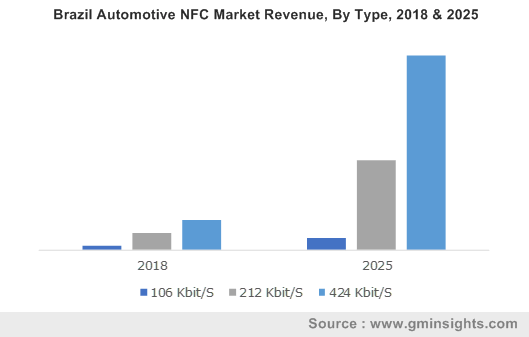

The 424 Kbit/S type NFC components accounted for 60% share in the automotive NFC market, which is attributed to the growing use of various multi-media-based devices such as video players and rear-view cameras in automobiles. The automotive landscape has been gradually shifting toward the 424 Kbit/S due to the influx of highly interconnected automotive components. These products are fully compliant with the requirement for fast & highly secure data transmission and flexible infrastructure. The 424 Kbit/S products adhere to all the open global standards for air interface & cryptographic methods, making it a safe & highly reliable alternative for OEMs and automotive players to enhance their product performance without compromising on safety and security of the data being transmitted.

Browse key industry insights spread across 200 pages with 204 market data tables & 31 figures & charts from the report, “Automotive NFC Market Size By Type (106 Kbit/S, 212 Kbit/S, 424 Kbit/S) By Vehicle Type (Low-End, Mid-Range, High-End), By Application (Interior, Exterior), Industry Outlook, Regional Analysis, Application Development, Competitive Landscape & Forecast, 2019 - 2025” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/automotive-nfc-market

The high-end vehicles in the automotive NFC market will register a growth rate of more than 31% over the forecast timeline. The rising incorporation of smart driving applications into various high-end passenger cars is rapidly transforming the automobile landscape by improving security and enhancing driver experience. The use of NFC technology has been a key part in augmenting the driver experience, bringing personalized entertainment and connected infrastructure in the car environment in a safe & easy-to-use manner. The automotive suppliers and car manufacturers are forming tie-ups with prominent automakers to develop customized NFC solutions for their automobiles.

The interior application held over 71% revenue share in the automotive NFC market in 2018. The interior market includes infotainment system, air-conditioning, engine access, and ADAS communication interfaces. The interior application of NFC technology is used from low-end to high-end vehicles. The NFC technology is used for various interior applications such as communication support, the interaction between a driver and car, and information retrieval. The ability of the NFC technology to simplify the pairing process is the primary factor driving its usage in the automotive landscape. Without the use of NFC technology, it requires over eight different interactions to establish the first connection between a car and a smart device. The use of NFC technology substitutes these transactions with a single transaction that only requires the NFC device to be held over an automobile’s NFC dashboard.

The North America automotive NFC market will attain a CAGR of over 32% over the projected time period due to the introduction of various road safety guidelines mandating the use of ADAS systems. The automakers in the region are incorporating advanced smart driving features into automobiles, which has generated a myriad of opportunities in the integration of NFC solutions in vehicles. The increasing number of initiatives aimed at advanced innovations in the autonomous landscape in the region coupled with a favorable regulatory landscape has further added to the growth of the market.

The players in the automotive NFC market are building partnerships with other automotive manufacturers to develop new & advanced NFC solutions for automobiles. The automakers are keen on launching NFC-based smart car solutions for their product offerings to gain an edge over their competitors. For instance, in December 2018, BMW launched NFC-based digital keys for its X5 and X8 series cars. The digital keys functionality will allow drivers to lock & unlock their cars and start the engine with their NFC smartphones. It will also provide drivers the option to share their digital key over the air with up to five other individuals.

Some of the companies present in the automotive NFC landscape are Texas Instruments, Telit, STMicroelectronics, Sony, Smartrac, Samsung Semiconductors, PREMO, Panasonic, NXP Semiconductors, Broadcom, and Alpine Electronics.

The global automotive NFC market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue from 2015 to 2025, for the following segments:

Automotive NFC Market, By Type

- 106 Kbit/S

- 212 Kbit/S

- 424 Kbit/S

Automotive NFC Market, By Vehicle Type

- Low-End

- Mid-Range

- High-End

Automotive NFC Market, By Application

- Interior

- Exterior

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Asia Pacific

- Australia

- China

- India

- Japan

- South Korea

- Latin America

- Mexico

- Brazil

- MEA

- GCC

- South Africa