Home > Pressrelease > Automotive Robotics Market worth over $5.96bn by 2024

Automotive Robotics Market worth over $5.96bn by 2024

- Published Date: August 24, 2017

Automotive Robotics Market size is projected to reach USD 5.96 billion by 2024; according to a new research report by Global Market Insights Inc.

Growth in automobile industry is creating positive impact over the implementation of advanced products to meet the customer demand. Improved focus of vendors on automation solutions to eliminate risk factors arising from labor will spur the demand for automotive robotics. Additionally, extensive usage of robotics will lead to reduction of labor costs and thereby increase OEMs profitability.

Necessity for better productivity and proper functioning of assembly lines in vehicle production has enhanced automotive robotics market growth. Increasing technological advancements in raw materials used for robot making will escalate the market demand.

Increasing demand from applications such as welding, robotic processing, painting & dispense, and handling operations will augment the industry growth rate. Further, benefits offered including light weight, easy deployment, durable and space saving is predicted to increase the market penetration.

Technical support will facilitate the product as an alternative for skilled labors. Growth in R&D activities will support the industry growth. It has unlocked multiple avenues for automakers to offer its customers with increased versatility, flexibility, and reliability.

Get more details on this report - Request Free Sample PDF

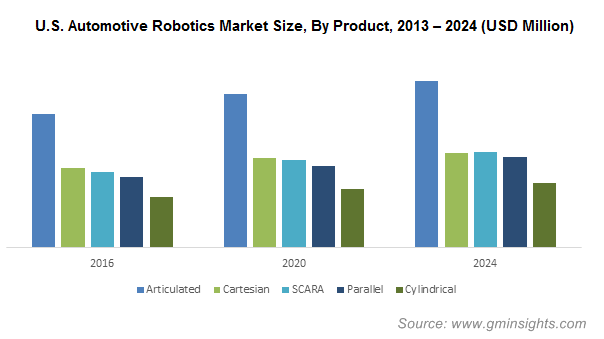

SCARA robots demand will cross 33 thousand units by 2024. This can be credited to increasing usage in applications such as high-speed assembly and handling operations. Rising demand for reduced bottlenecks and optimized productivity will boost the market penetration.

Parallel robots will witness over 4% CAGR through 2024. Micro-manufacturing automation is a key factor that will fuel the market demand over the forecast time frame. High speed, stiffness, and flexible fixturing are the benefits supporting the market size.

Browse key industry insights spread across 400 pages with 629 market data tables & 11 figures & charts from the report, “Automotive Robotics Market Size By Product (Articulated, Cartesian, SCARA, Parallel, Cylindrical), By Component (Hardware [Controllers, Arms, End Effector, Drive, And Sensor], Software & Services), By Application (Welding, Assembly, Processing, Handling Operations, Paint & Dispense), Industry Analysis Report, Regional Outlook (U.S., Canada, Mexico, UK, Germany, Italy, France, Spain, Sweden, Denmark, Belgium, China, India, Japan, South Korea, Australia, Singapore, Thailand, Brazil, Argentina, Colombia, Saudi Arabia, UAE, South Africa), Application Potential, Price Trends, Competitive Market Share & Forecast, 2017 – 2024” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/automotive-robotics-market

Software and services segment will exceed USD 1 billion valuation by 2024. Improved software programming has enhanced the quality eventually driving the industry growth. Software loaded in the product will enable real time decision making in the production process supporting the industry growth.

Automotive robotic controllers are the most used hardware and will register gains of over 4% during the forecast period. High acceptance of robotic arms is required in areas, where repetitive tasks are performed. Easy installing, lightweight model, and space-saving ability are the features, accelerating the robotic arms segment growth.

Handling operations dominated the market share in 2016 owing to lifting tasks meeting several demands of the automakers. Safety regulations for these advanced products has resulted in employee’s well-being coupled with minimized associated injuries.

In 2016, APAC automotive robotics market was approximately USD 2 billion. The region is predicted to have highest overall industry share owing to product’s motion control technology. Further, the region has substantial number of vehicle manufacturing facilities contributing to the market revenue.

Global industry consists of several players and the key players are ABB, KUKA, Fanuc, and Yamaha acquiring significant market share in 2016. Other notable players include Omron Corporation, Kawasaki Heavy Industries, Rockwell Automation, Staubli, and Universal Robots.

Strategies including partnerships and new product launches are being adopted by these companies. KUKA entered in partnership with Volkswagen for enhancement of electric autonomous vehicles in July 2017.