Home > Packaging > Packaging Materials > Plastic Packaging > Polyvinyl Alcohol (PVA) Films Market

Polyvinyl Alcohol (PVA) Films Market Size By Application (Water Soluble [Detergent Packaging, Agrochemical Packaging, Laundry Bags, Embroidery], Polarizer [LCD Panels]), Industry Analysis Report, Regional Outlook, Application Potential, Price Trends, Competitive Market Share & Forecast, 2020 – 2026

- Report ID: GMI687

- Published Date: Jul 2020

- Report Format: PDF

Polyvinyl Alcohol Films Market Size

Polyvinyl Alcohol (PVA) Films Market size exceeded USD 290 Million, globally in 2019 and is estimated to grow at over 5.5% CAGR between 2020 and 2026, whereas polarizing application of PVA films market surpassed USD 7 billion in 2019.

Polyvinyl alcohol film is fully biocompatible, nontoxic and its waste does not produce any toxic or harmful by-products when digested or incinerated in the environment. These substances have good barrier properties to gases such as carbon dioxide, oxygen and nitrogen. Strong outlook in packaging of food, drugs, cosmetics and single-use packaging applications, such as detergents will foster the polyvinyl alcohol films market demand.

Comprehensive functional properties including outstanding heat-sealing, uniaxial tensile stress, and excellent adhesion to hydrophilic surfaces will drive the growth of polyvinyl alcohol films market. Also, salient features such as water solubility, chemical resistance and ease-of-use in applications such as agrochemical and detergent wrapping will boost their usage globally.

Rising consumer awareness regarding cleaning and maintaining a hygienic atmosphere in their surrounding has led to an increase in the usage of detergents and laundry bags. Moreover, upsurge in utilization of detergents by hospitality industries such as hotels, resorts, amphitheaters, and entertainment industry is anticipated to increase PVA films demand.

| Report Attribute | Details |

|---|---|

| Base Year: | 2019 |

| Polyvinyl Alcohol Films Market Size in 2019: | 445.48 Million (USD) |

| Forecast Period: | 2020 to 2026 |

| Forecast Period 2020 to 2026 CAGR: | 5.5% |

| Historical Data for: | 2015 to 2019 |

| No. of Pages: | 128 |

| Tables, Charts & Figures: | 175 |

| Segments covered: | Application |

| Growth Drivers: |

|

| Pitfalls & Challenges: |

|

Stringent government regulations restricting the use of synthetic packaging materials has urged numerous packaging companies to switch towards biodegradable items such as polyvinyl alcohol film. Market profitability may get effected due to the availability of substitutes and fluctuating petrochemical prices responsible for the unstable PVA film prices. Increased public efforts to promote sustainable & green packaging will fuel the polyvinyl alcohol films market growth.

Polyvinyl Alcohol Films Market Analysis

The global market is bifurcated based on application as water soluble and polarizer. Water soluble application is further segmented as detergent packaging, agrochemical packaging, laundry bags, embroidery, and others. Rising consumer awareness & focus towards maintaining health and hygiene will propel the product demand in single-use packaging products such as detergents.

Moreover, the biodegradable, water soluble, and low-toxic nature of the product has increased its adoption for detergent packaging. These are frequently used to meet the strict requirements of many governmental and industrial standards which is likely to simulate the growth of polyvinyl alcohol films market.

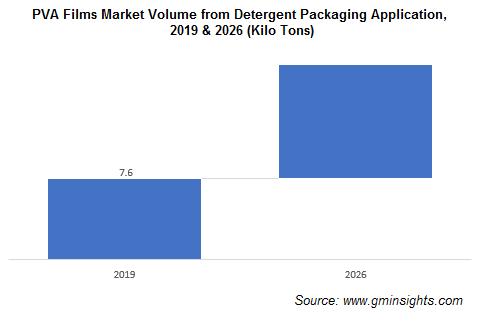

Detergent packaging application witnessed a consumption of over 7.5 kilo tons in 2019. Polyvinyl alcohol films market growth is attributed to stringent environmental regulations on waste disposal and green packaging initiatives in North America and Europe. They are compatible with detergents and are decomposed when in contact with water.

Rising detergent demands owing to rise in global population, industrialization and purchase power parity of consumers will provide lucrative business opportunities for industry expansion.

Polarizer applications of polyvinyl alcohol film are bifurcated into LCD panels and others. PVA films serve as polarizers which allow the display of bright & clear images on liquid crystal display (LCD) screens, thereby making them essential elements of LCD technology. The LCD panel industry has witnessed high production levels and capacity expansion which has resulted in tremendous price reduction and aggressive market growth. PVA films market size from LCD polarizers surpassed USD 6.4 billion in 2019.

Consumers, primarily among the Gen X, Gen Z and the millennial segments, are increasingly engaged in television viewing on mobile devices such as smartphones and tablets. The substantial penetration of high-speed mobile data, rising prevalence of smart devices and growing video streaming services has increased TV viewership on mobile devices. LCD panels find extensive adoption in smartphones on account of their excellent image quality, and low power demand which should stimulate the growth of polyvinyl alcohol films market.

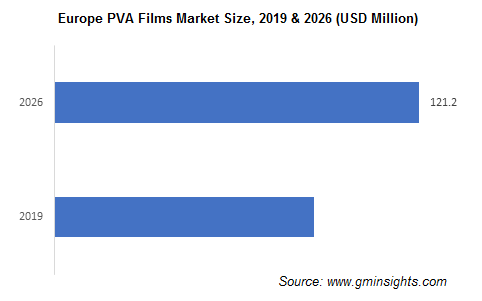

Polyvinyl alcohol films market size in Europe may surpass USD 120 million by 2026. Growing focus on ensuring the satisfaction of future food requirements in a sustainable manner and increasing awareness among farmers regarding nutrient requirement of plants should drive the demand for fertilizers in the region. Technological advancements have resulted in the development of improved fertilizer products which target specific crops, thus ensuring nutrient-use efficiency and increases yields.

PVA films are witnessing rising adoption for fertilizer and pesticide packaging owing to their water soluble and biodegradable nature which reduces plastic pollution.

Europe has witnessed a decline in arable land but the food requirement has increased which has boosted the requirement for crop protection products to retain & enhance crop yields. Rising environmental concerns regarding the usage of chemical pesticides and favorable government policies should stimulate the adoption of biopesticides.

The European Union has banned various pesticides such as imidacloprid, clothianidin and thiamethoxam on account of their toxic impact on bees. EU Directive 2009/128/EC advocates for the lower usage of pesticides and promotes non-chemical methods such as biopesticides which should stimulate the growth of polyvinyl alcohol films market.

Polyvinyl Alcohol Films Market Share

Global polyvinyl alcohol films industry is significantly consolidated with key players including:

- MonoSol LLC

- Sekisui Specialty Chemicals

- Nippon Gohsei

- Aicello Chemicals.

Companies are engaged in strategic acquisitions to expand their product portfolio and meet rising product demand from the detergent & agrochemical sectors. In October 2018, global chemicals provider Mitsubishi Chemicals Corporation (MCC) announced the acquisition of its consolidated subsidiary Nippon Synthetic Chemical Industry, a manufacturer & distributor of specialty polymers, ethylene vinyl alcohol and polyvinyl alcohol films.

This absorption merger integrates the company’s management resources, increases the profits of existing businesses and ensures growth of associated businesses in the MCC Group.

In February 2020, Kuraray, the parent company of MonoSol announced plans to construct a new facility for the manufacture of polyvinyl alcohol films in Poland. This new facility should allow the company to meet growing demand from packaging applications, optimize its supply chain and achieve polyvinyl alcohol films market growth in Europe.

The polyvinyl alcohol films market report includes in-depth coverage of the industry trends, with estimates & forecast in terms of volume (Tons) and revenue (USD Million) from 2015 to 2026, for the following segments:

Click here to Buy Section of this Report

By Application

- Detergent packaging

- Consumer detergent

- Industrial detergent

- Agrochemical packaging

- Laundry bags

- Embroidery

- Other

The above information has been provided for the following regions and countries:

By Region

- PVA Films Market from Water Soluble applications

- North America

- U.S.

- Europe

- Germany

- UK

- France

- Italy

- Russia

- APAC

- China

- Japan

- India

- Malaysia

- Thailand

- Australia

- Indonesia

- LATAM

- Brazil

- MEA

- Saudi Arabia

- South Africa

- UAE

- North America

- PVA Films Market from Polarizer applications

- South Korea

- Japan

- Taiwan

- China