Home > Chemicals & Materials > Textiles > Nonwoven Materials > Global Polypropylene (PP) Nonwoven Fabrics Market

Global Polypropylene (PP) Nonwoven Fabrics Market Size By Product (Spunbonded, Staples, Meltblown, Composite), By Application (Hygiene [Baby Diapers, Feminine Hygiene, Adult Incontinence, Wipes], Industrial, Medical, Geotextiles, Furniture, Carpet, Agriculture), Industry Analysis Report, Regional Outlook, Industry Analysis Report, Regional Outlook, Application Development Potential, Price Trends, Competitive Market Share & Forecast, 2020 – 2026

- Report ID: GMI838

- Published Date: May 2020

- Report Format: PDF

Polypropylene Nonwoven Fabrics Market Size

Polypropylene (PP) nonwoven fabrics market size exceeded $27 billion, globally in 2019 and is estimated to exceed above 11% CAGR between 2020 and 2026. Rapid demand for adult incontinence and hygiene products will foster market growth during the forecast period.

Polypropylene nonwoven fabrics are fabric like materials which are produced from short staple fibers and long fibers, bonded by mechanical, chemical, or heat treatment. They are mainly used in the textile manufacturing industry. Nonwoven fabrics are mainly engineered fabrics, which have a limited life, are durable, and can be used only once. They provide functions such as liquid repellence, absorbency, softness, flame retardancy, strength, thermal insulation, bacterial barrier, acoustic insulation, and wash ability.

Polypropylene (PP) is the key raw material used for producing nonwoven fabrics owing to low cost, flexibility, moderate strength & stability, lightweight, excellent moisture resistance, high temperature resistance, and insulation properties. PP nonwoven fabrics have wide applications in geotextiles, furniture, medical, hygiene products, agriculture, and medical.

| Report Attribute | Details |

|---|---|

| Base Year: | 2019 |

| Polypropylene (PP) Nonwoven Fabrics Market Size in 2019: | 27.2 billion (USD) |

| Forecast Period: | 2020 to 2026 |

| Forecast Period 2020 to 2026 CAGR: | 11% |

| 2026 Value Projection: | 55 Billion (USD) |

| Historical Data for: | 2015 to 2019 |

| No. of Pages: | 350 |

| Tables, Charts & Figures: | 553 |

| Segments covered: | Product & Applications |

| Growth Drivers: |

|

| Pitfalls & Challenges: |

|

Increasing application scope in hygiene products including female hygiene products and baby diapers is likely to stimulate polypropylene nonwoven fabrics market value of nonwoven fabrics owing to their properties such as lightweight, softness, high strength wet & dry, free from chemical agents, and dermatologically neutral. These key performance metrics increase application scope in baby diapers, which are appropriate for infant’s delicate skin.

Rapid technological advancements and innovations in this field, such as design of nonwoven fabrics with skincare and softness, have further led to the polypropylene nonwoven fabrics market growth. For instance, in December 2017, Arvind Ltd. and OG Corporation of Japan entered into a joint venture for manufacturing and trading specialized materials.

The new manufacturing facility in India will help OG Corporation to expand its business in India within the nonwoven fabrics space. The joint venture will produce high-quality non-woven fabrics using needle-punch technology for artificial leather, bag-house filtration, and other applications.

However, the polypropylene nonwoven fabrics market share may be hampered by strict regulations imposed by regulatory authorities and the unorganized textile industry. Strict regulations imposed by REACH over environmental concerns may impact industry growth. Rising cases of COVID 19 among population have disrupted manufacturing industries and supply chains, hindering market growth to a certain extent. Consumers are significantly reducing purchases across all product categories owing to adverse effects of the COVID-19 pandemic on employment.

Polypropylene Nonwoven Fabrics Market Analysis

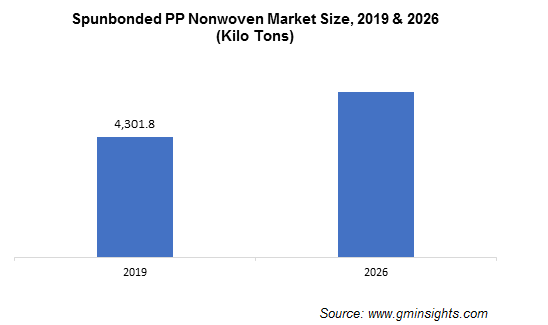

Spunbonded-based PP nonwoven fabric was 4.3 million tons in 2019 and is forecast to grow at a CAGR of over 10% through 2026. Spunbonded nonwoven fabrics are produced from integration of web formation, fiber spinning, and bonding process. These are highly used in manufacturing lightweight fabrics and are considered for their cost-effectiveness and economical option to produce nonwoven fabric materials.

The widening application scope in applications including medical, hygiene, furniture, construction, automotive, geotextiles, agriculture, household, and packaging will spur global polypropylene nonwoven fabrics market.

Spunbonded nonwoven fabrics are available in various eco-friendly options including shopping bags, packing bags, carrier bags, and gift bags. The rising utilization of spunbonded fabrics in personal care and hygiene industries due to their liquid repellence, softness, and absorbent properties will boost durable and disposable polypropylene nonwoven fabrics market manufacturing.

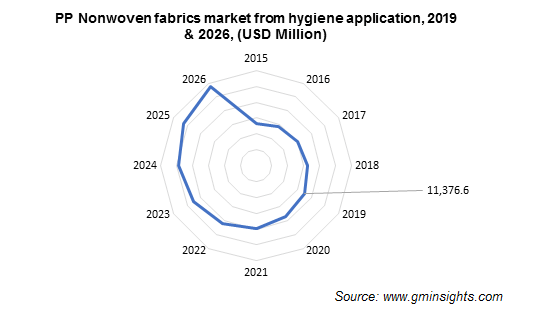

Based on application, it is segmented into hygiene, industrial, medical, geotextiles, furniture, carpet, agriculture, and others. The polypropylene nonwoven fabrics market from hygiene application was valued at USD 11.3 Billion in 2019. Polypropylene nonwovens are used in production of hygiene-related products such as baby diapers, wet wipes, adult incontinence products, bandages & wound dressings, and feminine hygiene.

Frequent usage and demand for baby diapers and skin wipes to avoid rashes on baby’s skin are anticipated to stimulate overall product growth. Increasing infant population along with high demand for disposable products such as baby diapers and wipes from developing economies, such as India and China, will supplement the polypropylene nonwoven fabrics market demand.

Managing hygiene is important for good health, prevents various infectious diseases and promotes personal wellbeing. Leading producers of disposable diapers are keen on improving product thinness to ensure comfort among babies and infants and minimize the environmental impact of the polypropylene nonwoven fabrics market. These disposable diapers are developing highly absorbent cores engineered with high levels of superabsorbent polymers, thereby decreasing bulkier material levels.

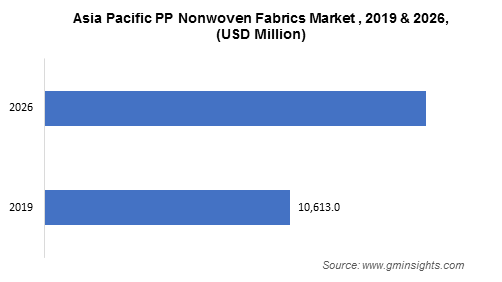

The Asia Pacific was valued at USD 10.6 billion in 2019 and is anticipated to exceed 12% growth rate during the estimated timeframe. Most of the Asian countries are still at the preliminary stage in marketing adult incontinence products, escalating industry growth soon. Growing urinary incontinence products demand among adults and unwillingness to go through intrusive procedures will further drive the polypropylene nonwoven fabrics market value.

According to the Australian Institute of Health and Welfare, urinary incontinence affects 37% of women and 13% of men in Australia. Most of the consumers in India are not aware of adult incontinence products. The main reason is lack of promotional activities and advertisements by various brands. Additionally, limited availability of these products in India compared to other hygiene products is likely to restrict adult incontinence in the polypropylene nonwoven fabrics market.

Polypropylene Nonwoven Fabrics Market Share

Some of the companies in the polypropylene nonwoven fabrics industry include:

- First Quality

- Kimberly Clark

- AVGOI

- Fibetex

- Toray

- Mitsui

- SABIC

- Fitesa

- ExxonMobil

- PEGAS.

The industry is witnessing further consolidation with large players acquiring small entrants in the market.

Industry leaders are majorly involved in research & development activities to cater to the growing polypropylene nonwoven fabrics market demand. For instance, in March 2020, Berry launched an extension to its Synergex range of products for facemask application. The newly introduced mask will provide a multilayer of non-woven fabrics in a single sheet as an alternative to traditional facemask layer structure.

polypropylene nonwoven fabrics market report includes in-depth coverage of the industry trends, with estimates & forecast in terms of Kilo Tons and revenue (USD Million) from 2015 to 2026, for the following segments:

Click here to Buy Section of this Report

By Product

- Spunbonded

- Staples

- Meltblown

- Composite

By Application

- Hygiene

- Baby diapers

- Feminine hygiene

- Adult incontinence

- Wipes

- Industrial

- Medical

- Geotextiles

- Furniture

- Carpet

- Agriculture

- Others

The above information has been provided for the following regions and countries:

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Poland

- Spain

- APAC

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Thailand

- Latin America

- Brazil

- MEA

- Saudi Arabia

- South Africa

- UAE

- Egypt