Home > Healthcare > Medical Devices > Therapeutic Devices > Neurovascular Devices Market

Neurovascular Devices Market - By Product (Embolic Coils, Carotid Stents, Intracranial Stents, Catheters, Embolic Protection Devices, Flow Diverters, Stent Retrievers, Guidewires), By Process, Therapeutic Applications, End-use & Global Forecast, 2023-2032

- Report ID: GMI794

- Published Date: Apr 2023

- Report Format: PDF

Neurovascular Devices Market Size

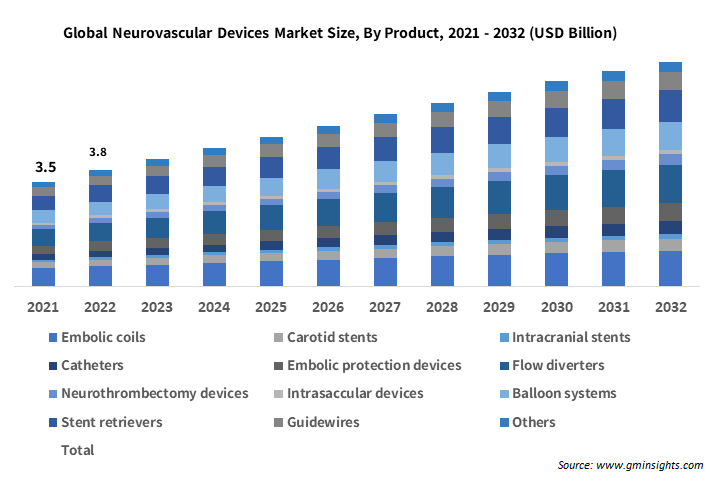

Neurovascular Devices Market size reached USD 3.9 billion in 2022 and is estimated to witness 6.5% CAGR between 2023 and 2032. Mounting incidences of ischemic strokes to strengthen the business outlook.

A remarkable surge in incidences of ischemic strokes and brain aneurysm across North America will enhance market performance over the next ten years. Besides, the growing prevalence of several neurological disorders will further add to market progress. For instance, according to a recent study published in The Lancet, neurological disorders were among the most common sources of health loss in the EU28 and the WHO European region.

| Report Attribute | Details |

|---|---|

| Base Year: | 2022 |

| Neurovascular Devices Market Size in 2022: | USD 3.9 Billion |

| Forecast Period: | 2023 to 2032 |

| Forecast Period 2023 to 2032 CAGR: | 6.5% |

| 2032 Value Projection: | USD 7.5 Billion |

| Historical Data for: | 2018 to 2022 |

| No. of Pages: | 462 |

| Tables, Charts & Figures: | 630 |

| Segments covered: | Product, Process, Therapeutic Application, End-use and Region |

| Growth Drivers: |

|

| Pitfalls & Challenges: |

|

Minimally invasive surgeries are witnessing a high acceptance rate due to their cosmetic appeal and shorter recovery periods, which may further streamline neurovascular devices market expansion. Consistent innovations and improvements have been introduced in surgical procedures to make them safer for patients. Minimally invasive surgery has become the standard for surgical interventions traditionally done with an open method or technique. These surgical procedures include laparoscopic surgery, endoscopic surgery as well as robot-assisted surgery. Such scenarios are expected to favor industry landscape.

Neurovascular Devices market trends

Disease management in the case of intracranial aneurysms, arteriovenous malformation (AVMs), and strokes is a complex and challenging procedure since no single effective therapy is available for the same, generating a need for more innovative and effective therapies. The major reasons identified for ineffective treatments include complications of surgical therapies such as cerebral artery bypass and aneurysm clipping. Thus, the escalating need for designing more effective and low-cost treatments may hamper the market dynamics.

Neurovascular Devices Market Analysis

Neurovascular devices market share from the flow diverters segment is projected to observe a 7.5% CAGR from 2023 to 2032. Flow diverters are stent devices used in non-invasive endovascular surgery wherein it is placed in the parent blood vessel to disrupt intra-aneurysmal blood flow and change the transmural pressure gradient. Growing awareness among people regarding the treatment and initiatives taken by the government to prevent the rate of intracranial aneurysms are a few other factors contributing to the market statistics. Also, the surgical procedure for flow diverters is less complicated than embolic coils and requires a shorter inpatient time, which will favor their adoption over the coming years.

Regarding the process, the stenting segment of the neurovascular devices market is poised to be worth over USD 1 billion by 2032. A stent is a small, expandable metal mesh coil that helps prevent artery closure during surgery. Therefore, a commendable rise in the number of stenting procedures for the treatment of complicated aneurysms that are not feasible to treat using coiling procedures will positively influence the industry landscape.

In terms of therapeutic application, the ischemic stroke segment amassed over 40% neurovascular devices market share in 2022. A noticeable surge in incidences of ischemic strokes, in line with the growing demand for minimally invasive procedures, may contribute to segment expansion. For instance, according to the Centers for Disease Control and Prevention (CDC) report, each year, approximately 7,95,000 individuals in the U.S. suffer from stroke and about 87 percent of that are ischemic strokes.

Neurovascular devices market from hospital segment is anticipated to emerge as a potential revenue hub and garner a valuation of over USD 3.5 billion by 2032. The higher adoption rate of neurovascular devices in hospitals, attributed to a rise in the number of patients suffering from neurovascular disorders, will favor the segment progress. Additionally, there has been an increase in the number of hospital admissions that strive to provide comprehensive treatment options for various brain and spine disorders, generating a huge demand for neurovascular devices.

From a regional perspective, the North America neurovascular devices market size surpassed USD 1.3 billion in 2022. This is attributed to the increasing prevalence of ischemic strokes, in line with the rising number of surgeries across North America. The surge in funding for advanced healthcare research, high per capita healthcare expenditure, and implementation of favorable reimbursement policies will further boost the overall market growth.

Neurovascular Devices Market Share

Leading companies in the neurovascular market include:

- Asahi Intecc Co Ltd

- Integer Holdings Corporation

- Johnson & Johnson Services

- Kaneka Medix Corp

- Medtronic

- MicroPort Scientific Corporation

- Merit Medical System

- Penumbra Inc

- Stryker,

- Terumo Corporation.

Impact of the COVID-19 pandemic

COVID-19 severely impacted the global economy, including all developing and developed nations, disrupting operations across every sector and organization operating within, irrespective the size. The healthcare sector was largely affected by the increasing prevalence of COVID-19 cases. While the impact of COVID-19 has been mostly negative in several areas, neurovascular devices witnessed a moderate impact than before in the early months of the pandemic, mainly due to a decline in non-essential medical procedures and limited patient footfall across healthcare settings during the crisis.

Neurovascular devices market research report includes an in-depth coverage of the industry with estimates & forecast in terms of revenue in USD from 2018 to 2032, for the following segments:

Click here to Buy Section of this Report

By Product

- Embolic Coils

- Carotid Stents

- Intracranial Stents

- Catheters

- Embolic Protection Devices

- Flow Diverters

- Neurothrombectomy Devices

- Intrasaccular Devices

- Balloon Systems

- Stent Retrievers

- Guidewires

- Others

By Process

- Neurothrombectomy Procedure

- Cerebral Angiography Technique

- Carotid Endarterectomy (CEA)

- Stenting

- Microsurgical Clipping

- Coiling

- Flow Diversion

- Others

By Therapeutic Applications

- Brain Aneurysm

- Stenosis

- Ischemic Strokes

- Others

By End-use

- Hospitals

- Ambulatory Surgical Centers

- Clinics

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Turkey

- Netherlands

- Belgium

- Austria

- Switzerland

- Poland

- Czech Republic

- Hungary

- Portugal

- Greece

- Romania

- Bulgaria

- Denmark

- Sweden

- Norway

- Finland

- Asia Pacific

- Japan

- China

- India

- Australia

- Korea

- Singapore

- Hong Kong

- Taiwan

- Indonesia

- Cambodia

- Philippines

- Vietnam

- Malaysia

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- UAE