Home > Healthcare > Medical Devices > Rehabilitation and Assistive Devices > Medical Bed Market

Medical Bed Market Size By Product (Acute Care Beds {MedSurg Beds, ICU Beds, Pediatric Beds, Birthing Beds}, Long-term Care Beds, Psychiatric Care Beds, Bariatric Beds), By Bed Type (Manual Beds, Electric Beds, Semi-electric Beds), By Application (Intensive Care, Non-intensive Care), By Medical Institution/Facility (Private Medical Institutions, Public Medical Institutions), By End-use (Hospitals, Home Care Settings, Elderly Care Facilities), Industry Analysis Report, Regional Outlook, Application Potential, Price Trends, Competitive Market Share & Forecast, 2020 – 2026

- Report ID: GMI1883

- Published Date: Nov 2020

- Report Format: PDF

Medical Bed Market Size

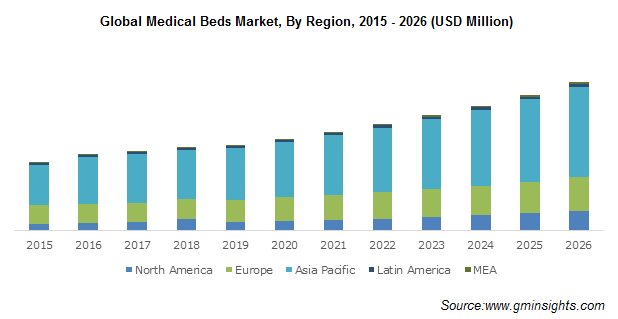

Medical Bed Market size exceeded USD 17.6 billion in 2019 and is projected to grow at over 8.3% CAGR from 2020 to 2026. The rise in incidence of hospitalization and medical emergencies across the globe is propelling the market growth. Growing geriatric population suffering from chronic diseases is leading to increase in number of hospital admissions.

Increasing funding on healthcare infrastructure is resulting in development of well-equipped, well-furnished and advanced infrastructure in the hospitals. Furthermore, rising number of private hospitals across the developing economies is fostering the market revenue during the forecast timeframe. However, several cases of patient entrapment have been reported in the recent years. According to a published article, FDA received 901 incidents of patient entrapment in the last few decades leading to non-fatal injuries.

The recent outbreak of COVID-19 at a global level, the number of patients requiring intensive care and advanced healthcare services has increased. The ongoing pandemic has also led to an increase in number of patients suffering from severe respiratory conditions associated with swallowing disorders.

To address adequate nutritional intake, these patients require hospitalization. Pediatric and geriatric population pool is prone to pneumonia that is leading to an increase in number of hospitalized patients requiring intensive care. Cancer patients undergoing chemotherapy also require special care at home and hospitals. These factors have exponentially augmented the adoption of medical beds due to the onset of COVID-19 pandemic.

The increasing geriatric population across the globe will majorly drive the medical bed market expansion through 2026. According to a published report, the geriatric population is growing at a rate of 2.6% per year, worldwide. With continuous rise in geriatric population, the incidence of chronic disorders and injuries among the elderly population have increased resulting in spurring the demand of medical beds. The health of elderly patients deteriorates with aging and induces the adoption for long-term care beds.

The elderly population is prone to mechanical falls that result in injuries and need intensive care at home and hospitals. The elderly population is also prone to chronic illnesses such as cardiovascular disorders, neurological & mental health disorders and diabetes, thereby requiring effective treatment, special care and attention.

| Report Attribute | Details |

|---|---|

| Base Year: | 2019 |

| Medical Bed Market Size in 2019: | 17.6 Billion (USD) |

| Forecast Period: | 2020 to 2026 |

| Forecast Period 2020 to 2026 CAGR: | 8.3% |

| 2026 Value Projection: | 30.54 Billion (USD) |

| Historical Data for: | 2015 to 2019 |

| No. of Pages: | 251 |

| Tables, Charts & Figures: | 365 |

| Segments covered: | Product, Bed Type, Application, Medical Institution/Facility and End-use |

| Growth Drivers: |

|

| Pitfalls & Challenges: |

|

There has been a significant rise in the number of installations of long-term care and intensive care unit beds in hospitals. Hence, growing geriatric population suffering from chronic disorders has resulted in rising the need for effective patient care in hospitals and other healthcare settings.

Medical Bed Market Analysis

Psychiatric care beds segment is anticipated to witness around 9.5% growth rate till 2026 led by the increasing prevalence of mental health disorders globally. Psychiatric patients suffering from schizophrenia need long-term care and the treatment of these patients is carried out in psychiatric hospitals in order to provide them specialized care in controlled environment.

In addition, rising number of psychiatric patients in the U.S. and UK has outnumbered the supply of psychiatric beds, thus resulting in maintaining a consistent demand for psychiatric care beds in the countries.

Manual medical bed market accounted for more than USD 4.96 billion in 2019 impelled by the lack of risk of motor failure, cost-effectiveness and user-friendly mechanisms in the manual beds. Manual beds are widely used in healthcare institutions of emerging economies where sophisticated healthcare facilities are not available.

Healthcare professionals are highly dependent on manual hospital beds in rural areas owing to the shortage of advanced medical facilities and low cost of manual beds. Manual bed provides several types of bed positions as per the patient’s needs with the help of hand cranks.

Intensive care medical beds market is estimated to attain a CAGR of 9.9% through 2026 driven by the enhanced and effective risk management, better comfort, design to support infection control, safety, user-friendly and efficiency in patient care provided by intensive care beds.

Increase in prevalence of chronic diseases such as diabetes and asthma, growing number of surgical procedures and rise in geriatric population are additional factors uplifting the demand for intensive care beds. The onset of coronavirus pandemic has further increased the number of intensive care bed installations.

Private medical institution segment crossed USD 10.94 billion revenue in 2019 on account of better hygiene and hospitality in private medical institutions/facilities. There is an increase in development of private facilities in the countries where public sectors work poorly. According to the National Center for Biotechnology Information (NCBI), about 45% of HIV patients in Africa prefer treatment in private medical facilities.

Availability of technologically advanced medical machines in private medical facilities/institutions has boost the number of patient admissions in private hospitals.

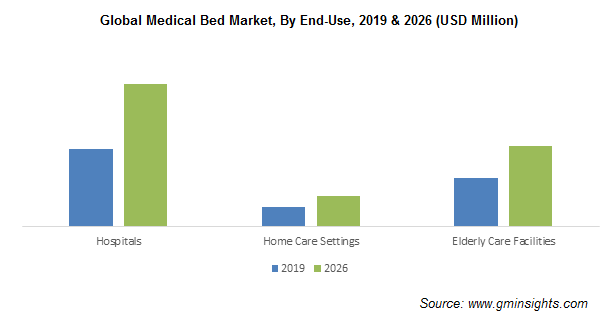

Hospitals end-use segment in the medical bed market exceeded USD 9.39 billion in 2019 led by the high inflow of patients requiring surgery pertaining to chronic disorders. Growing incidence of accidents leading to fatal injuries has also impacted the need for medical beds. Moreover, increasing number of public hospitals to provide cost-effective treatment to patients has spurred the number of medical bed installation in hospitals.

The number of patients admissions in hospitals has increased due to the availability of large number of skilled medical professionals in hospitals, that has led to uplifting the demand for hospital beds.

Canada medical bed market will observe substantial growth of around 18.8% between 2020 and 2026 on account of the continuous increase in number of COVID-19 patients in Canada that has resulted in significant increase in hospital admissions for critical care. The substantial need for medical beds and critical care has in-turn augmented the industry growth.

Rising healthcare expenditure in the country has significantly uplifted the number of medical beds installations in the country. According to the Canadian Institute for Health Information (CIHI), the total healthcare expenditure in Canada was USD 264 billion in 2019.

France medical beds market is estimated to grow at 13.2% CAGR through 2026 propelled by the fully integrated network of public hospitals, private hospitals and other medical service providers that maintain a consistent demand for medical beds in the country. Rising healthcare expenditure and favorable reimbursement scenario in the country is leading to accommodation of better facilities in the hospitals. Growing elderly population and increasing patient population is also fostering the demand for medical beds in the country.

Medical Bed Market Share

Some of the major companies operating in the medical bed market are

- Antano Group

- Besco Medical

- Gendron Inc.

- Getinge AB

- GF Health Products, Inc.

- HARD Manufacturing Company, Inc.

- Invacare Corporation

- Hill-Rom Holdings

These key market leaders are engaged in making investments in the market that enables these players to garner maximum revenue share.

Also, the major industry participants focus on strategic mergers, acquisitions and collaborations in order to launch new products to expand their geographical presence and product portfolio.

Recent developments in the medical bed market:

- In March 2020, Hill-Rom announced to double the production of critical care products, including ICU and med-surg unit smart hospital beds to support COVID-19 response. The strategic move will expand the customer base and strengthen the industry position of the company.

- In August 2019, Invacare Corporation announced the launch of NordBed, a medical bed range to support people affected by reduced mobility and age-related health challenges. This strategic move expanded the company’s product portfolio of medical beds.

This medical bed market research report includes an in-depth coverage of the industry with estimates & forecast in terms of revenue in USD and in terms of volume in Units from 2015 to 2026, for the following segments:

Click here to Buy Section of this Report

Market, By Product, 2015 - 2026 (USD Million and Units)

- Acute Care Beds

- MedSurg beds

- ICU Beds

- Pediatric Beds

- Birthing Beds

- Others

- Long-term Care Beds

- Psychiatric Care Beds

- Bariatric Care Beds

- Others

Market, By Bed Type, 2015 - 2026 (USD Million)

- Manual

- Electric

- Semi-electric

Market, By Application, 2015 - 2026 (USD Million)

- Intensive Care

- Non-intensive Care

Market, By Medical Institution/Facility, 2015 - 2026 (USD Million)

- Private Medical Institutions

- Public Medical Institutions

Market, By End-Use, 2015 - 2026 (USD Million)

- Hospitals

- Home Care Settings

- Elderly Care Settings

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Poland

- Denmark

- Finland

- Norway

- Sweden

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Hong Kong

- Singapore

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- South Africa

- Saudi Arabia

- Qatar

- UAE