Home > Healthcare > Medical Devices > Diagnostic Devices > Hemoglobin Testing Devices Market

Hemoglobin Testing Devices Market Size By Product (Equipment {Point of Care [Portable, Handheld, Bench-top], Laboratory Analyzers} Consumables) By Technology (Chromatography, Immunoassay, Spectrophotometry), By End-use (Hospitals, Clinics, Laboratories, Home Care Settings, Blood Banks), Industry Analysis Report, Regional Outlook, Application Potential, Competitive Market Share & Forecast, 2019 – 2025

- Report ID: GMI4415

- Published Date: Nov 2019

- Report Format: PDF

Hemoglobin Testing Devices Market Size

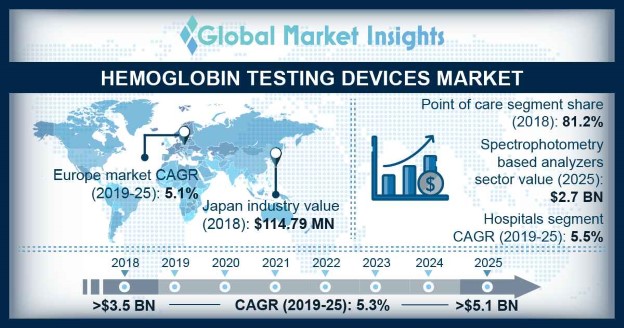

Hemoglobin Testing Devices Market size exceeded 3.5 billion in 2018 and is expected to register over 5.3% CAGR up to 2025.

Hemoglobin is an iron-based metalloprotein in the red blood cells of humans. Its key function is to transport oxygen from the lungs to the rest of the body. Hemoglobin test measures the level of hemoglobin or count the red blood cells (RBC) in blood. These tests are used extensively by physicians and doctors to diagnose any therapeutic conditions in the patient. If the results of the test depict a lower concentration of hemoglobin in the blood stream, it indicates higher chances of patients being anaemic. Rising prevalence of anaemia across the globe is a major factor augmenting hemoglobin testing devices industry growth.

| Report Attribute | Details |

|---|---|

| Base Year: | 2018 |

| Hemoglobin Testing Devices Market Size in 2018: | 3.5 Billion (USD) |

| Forecast Period: | 2019 to 2025 |

| Forecast Period 2019 to 2025 CAGR: | 5.3% |

| 2025 Value Projection: | 5 Billion (USD) |

| Historical Data for: | 2014 to 2018 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 295 |

| Segments covered: | Product, Technology, End-use and Region |

| Growth Drivers: |

|

| Pitfalls & Challenges: |

|

The introduction of hemoglobin analyzers can be traced back to late 1950’s for diagnosis of blood related disorders. Initially, hemoglobin analyzers were incorporated with single histogram per module, that creates error while estimating the total cell count. Hence, to overcome such difficulties hemoglobin analyzers with novel VCSn (volume, conductivity, light scatter) technology were introduced. Such technological advancement is one of the major factors driving the industry. Hemoglobin testing devices market is fragmented in nature with various companies operating in the market. Moreover, introduction of point of care hemoglobin analyzers has further augmented business growth. For instance, in 1991 HemoCue Inc. introduced HemoCue analyzer; a point of care based hematology analyzer for diagnosis of anaemia. Hence, the aforementioned factors are contributing significantly to drive the industry growth.

Rising technological advancements in the hemoglobin analyzers to tackle common laboratory challenges

Rising technological advancements in hemoglobin testing analyzers is another major factor stimulating industry growth. The traditional hematology analyzers have a few limitations while differentiating cellular elements, due to presence of single histogram per module. However, modern analyzers are incorporated with novel technology to gauge data from multiple histograms, thereby overcoming the limitations of traditional analyzers. Hence, such technological advancements will improve the test outcome and boost product demand across the forecast years.

However, product recalls due to irregularities and inaccuracy of hemoglobin testing results will hamper market growth. Moreover, high cost associated with hemoglobin testing analyzers will further limit market growth.

Hemoglobin Testing Devices Market Analysis

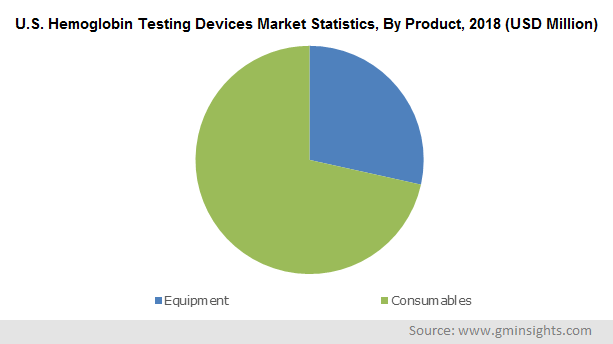

Product segment includes equipment & consumables, and the equipment segment is further bifurcated into point of care and laboratory based analyzers. The point of care segment accounted for 81.2% of the market in 2018. Point of care analyzers are used in broad spectrum of healthcare settings across the world. These analyzers provide accurate results in shorter time span, thus augmenting product demand. Danaher’s HemoCue is one the most widely used point of care hematology analyzer in various healthcare settings such as primary care, hospitals and blood banks. Moreover, increasing preference among the population for minimally invasive procedures will further augment business growth during the analysis period.

Hemoglobin analyzers are incorporated with various technologies such as spectrophotometry, chromatography, immunoassay and few others. Spectrophotometry based analyzers are estimated to hold maximum revenue of 2.7 billion in 2025. High growth is attributed to increasing number of companies adopting spectrophotometry as the chief technique for hematology testing. For instance, major players such as EKF diagnostics and Danaher are incorporating spectrophotometry technique for hemoglobin testing owing to its accuracy and efficiency in hemoglobin tests.

Hospitals as an end use are estimated to witness significant growth of 5.5% CAGR across the projected years. End-use segment is further divided into clinics, hospitals, laboratories, home care settings, blood banks and others. Hospitals will witness significant growth owing to presence of state-of-the-art facilities. Moreover, increasing preference among the population of developing economies for hospitals due to cost efficiency will further propel segmental growth. Also, increasing number of hospitals implementing hematology testing across the globe is another chief factor augmenting business growth.

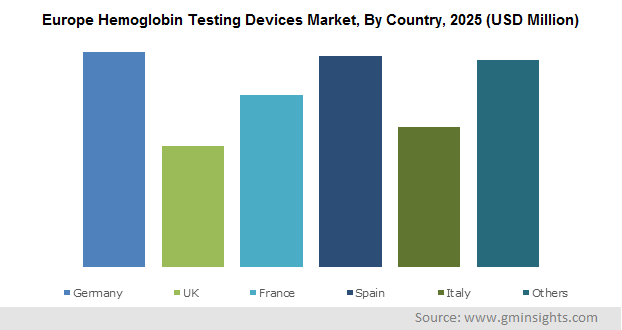

Europe hemoglobin testing devices industry is expected to show significant growth of 5.1% across the forecast timeframe. Increasing prevalence of anemia across the countries of Europe will significantly augment regional growth. For instance, as per World Health Organization (WHO), in Germany, prevalence rate of anemia is over 10% in 2018, and is projected to increase across the forecast timeframe. Moreover, anemia prevalence is even higher among women, with around 50% of women having low hemoglobin levels. Hence, rising prevalence of anemia across the European countries will considerably augment industry growth.

Growing number of research studies to explore novel therapeutic applications will boost the hemoglobin testing devices market growth in North America. The growth of North America hemoglobin testing devices industry is primarily driven by increasing R&D activities associated with hemoglobin analyzers with the aim to deliver better and efficient results. Moreover, presence of major players operating in the U.S. market will further augment business growth.

Hemoglobin Testing Devices Market Share

Few of the notable players operating in the industry are

- Abbott

- Danaher

- EKF Diagnostics

- Roche

- Biorad

- Siemens

- PTS Diagnostics

These players are implementing various strategies such as new product launch, acquisitions and collaborations, in order to capture high revenue share in hemoglobin testing devices business.

Recent industry developments:

- In May 2018, Abbott announced the launch of Afinion 2 analyzer in the U.S. The Afinion 2 analyzer is a compact multi-assay, rapid platform that simplifies and streamlines the readings of hemoglobin A1c in the human blood, thus delivering accurate results at the point of care. These strategic initiatives assisted the company to expand its hemoglobin testing device’s portfolio.

- In February 2016, Abbott completed its acquisition of Alere Inc., a leading company involved in manufacturing of point of care diagnostics. This strategic initiative enabled the company to strengthen its market presence in point of care testing business.

Hemoglobin testing devices market research report includes an in-depth coverage of the industry with estimates & forecast in terms of revenue in USD from 2014 to 2025, for the following segments:

Click here to Buy Section of this Report

By Product

- Pain Management

- Equipment

- Point of Care

- Portable

- Handheld

- Bench-top

- Laboratory Analyzers

- Point of Care

- Consumables

- Equipment

By Technology

- Chromatography

- Immunoassay

- Spectrophotometry

- Others

By End-use

- Hospitals

- Clinics

- Laboratories

- Home Care Settings

- Blood Banks

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Asia Pacific

- China

- Japan

- India

- Australia

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait