Home > Chemicals & Materials > Polymers > Industrial Polymers > Fluorinated Ethylene Propylene (FEP) Market

Fluorinated Ethylene Propylene (FEP) Market Size By Product (Granules [By Application {Electrical & Electronics Sector, Automotive, Aerospace, Chemical Processing}], Dispersions [By Application {Chemical Processing, Cookware & Food Processing, Electrical & Electronics Sector, Adhesives, Fabrics}], Film [By Application {Chemicals & Life Science Equipment, Electrical & Electronics Sector, Hot Melt Adhesives, Composite Molding, Solar Panels}], Powder [By Application {Chemical Processing, Cookware}], Tubes [By Application {Chemical Processing, Food Processing, Automotive, Medical}]), Industry Analysis Report, Regional Outlook, Application Potential, Price Trends, Competitive Market Share & Forecast, 2019 – 2025

- Report ID: GMI3263

- Published Date: Apr 2019

- Report Format: PDF

Fluorinated Ethylene Propylene Market Size

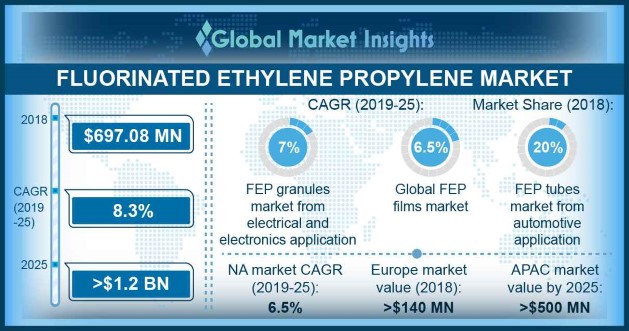

Fluorinated Ethylene Propylene (FEP) Market size valued at USD 695 million in 2018 and will expect consumption of over 40 kilo tons by 2025.

Growing power demand, awareness of renewable energy and decreasing solar energy price should stimulate fluorinated ethylene propylene market share on account of growing adoption of solar photovoltaic panels. Global solar photovoltaic manufacturing sector surpassed USD 90 billion in 2018 which indicates tremendous growth opportunities.

| Report Attribute | Details |

|---|---|

| Base Year: | 2018 |

| Fluorinated Ethylene Propylene Market Size in 2018: | 695 Million (USD) |

| Forecast Period: | 2019 to 2025 |

| Forecast Period 2019 to 2025 CAGR: | 8.3% |

| 2025 Value Projection: | 1.2 Billion (USD) |

| Historical Data for: | 2014 to 2018 |

| No. of Pages: | 330 |

| Tables, Charts & Figures: | 452 |

| Segments covered: | Product and Region |

| Growth Drivers: |

|

| Pitfalls & Challenges: |

|

These materials improve processability, moisture barrier, temperature resistance, UV resistance and transparency of energy generating devices. Favorable government initiatives, rising diesel & electricity prices and rising demand for energy self-sufficiency should further promote the market growth.

Significant population growth, and increasing urbanization are likely to increase product adoption pertaining to the rise in power demand for commercial & residential property construction. Global construction sector may surpass USD 15 trillion by 2030 which is an indicator of heathy growth potential.

These materials find extensive usage in architectural coatings owing to their beneficial impact on insulation, durability, chemical & water resistance, resistance to UV radiation and gas impermeability. Increased availability of lending, economic development and expansion of tourism sector are likely to accelerate the fluorinated ethylene propylene market growth.

This substance has significantly higher cost, low stiffness and strength as compared to other types of fluoroplastics such as PTFE which is likely to hinder the fluorinated ethylene propylene market growth. Moreover, this material releases perfluorooctanoic acid (PFOA) and perfluorinated compounds upon degradation which presents the risk of contaminating drinking water, groundwater, surface water and air. Various manufacturers are eliminating the use of PFOA to comply with industry and environmental requirements.

Fluorinated Ethylene Propylene Market Analysis

Fluorinated ethylene propylene powder segment exceeded USD 74 million in 2018 owing to favorable government policies, and growing demand from automotive and shipbuilding industries. These powders offer excellent melt fluidity, chemical resistant & smooth finish in the final product and imparts high weather resistance. Growing product demand for manufacturing various appliances such as washers & dryers, vending machines, refrigerators and microwaves should further promote fluorinated ethylene propylene market.

Granules segment from aerospace applications should surpass USD 35 million by 2025 pertaining to growing fleet replacement initiatives and growing adoption of fuel-efficient & lightweight aircraft. These materials are lighter than their substitutes which improves the speed of aircraft and enhances the fuel efficiency. Rising trend of military modernization and booming commercial airplane industry owing to increasing passenger volume should stimulate the fluorinated ethylene propylene (FEP) market trends.

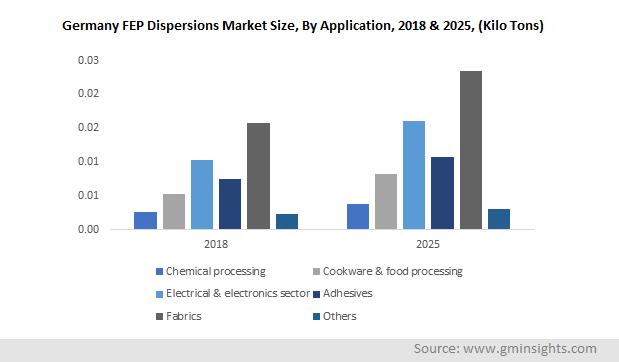

ispersions segment was valued at about USD 16.5 million in 2018 owing to rising demand for non-stick and heat resistant products. These products provide high chemical resistance, adhesion and non-stick properties, making them suitable for architectural fabrics & gaskets, industrial fabric, high performance cookware and glass cloth coating. Growing demand for industrial fabrics in flame resistant clothing and automotive carpets should further boost fluorinated ethylene propylene market.

Dispersions demand from fabrics applications is likely to register over 5% gains by the end of the predicted timeframe on account of growing demand from food processing & packing and architectural fabrics industries. These products offer various benefits such as high chemical resistance, superior wear & impact resistance, and reduced sliding friction. Growing apparel demand from China, India, Bangladesh and Mexico, increasing disposable income and urbanisation should further boost the growth of fluorinated ethylene propylene market.

North America driven by the U.S., Canada and Mexico surpassed USD 175 million in 2018 pertaining to growing demand from oil & gas industry. This product finds widespread use in various oil & gas equipment such as pumps, valves or pumps which are subjected to extreme temperature and chemicals. Growing prevalence of horizontal drilling & hydraulic fracturing, discovery of new oilfields and innovation in fracking techniques should boost the fluorinated ethylene propylene market.

Europe driven by France, UK, and Germany should surpass USD 240 million by 2025 owing to growing demand for premium lightweight vehicles. This product finds extensive usage in automotive O-rings, wire insulators, seals, diaphragms, and tank filler necks pertaining to its high resistance to fuels & high temperature. Rising government initiatives to promote electric mobility, smart traffic management and emission reduction should further boost lightweight automotive sector and stimulate product demand.

Asia Pacific driven by India, Japan, and China will register over 6.5% gains in the forecast period on account of rising demand for high-speed transmission cables from the booming 5G services industry. This material finds widespread usage in coating wires & cables for insulation and protecting the remaining structure from electric current owing to the product’s insulating & flame-resistant properties. Significant economic growth, government investment, evolving telecom industry and growing smart city initiatives are likely to accelerate the fluorinated ethylene propylene market growth.

Fluorinated Ethylene Propylene Market Share

Global FEP market share is highly consolidated with the presence of various prominent manufacturers such as

- The Chemours Company

- AMETEK

- BASF

- Daikin Industries

- Inoflon Fluoropolymers

Certain market participants are engaging in strategic acquisitions to satisfy rising product demand from electrical power, automotive & construction industries and ensure market expansion.

Industry Background

This product is a melt-processable copolymer of tetrafluoroethylene and hexafluoropropylene that allows efficient thermoforming and extrusion. It offers easy formability, chemical & friction resistance, non-toxicity, non-stick features and weatherability. Growing demand from photovoltaic, automotive, aerospace and electric wire & cable industries should fuel the fluorinated ethylene propylene industry growth.

The fluorinated ethylene propylene (FEP) market research report includes in-depth coverage of the industry, with estimates & forecast in terms of volume in Tons and revenue in USD from 2014 to 2025, for the following segments:

Click here to Buy Section of this Report

By Product

- Granules

- By application

- Electrical & electronics sector

- Automotive

- Aerospace

- Chemical processing

- Others

- By application

- Dispersions

- By application

- Chemical processing

- Cookware & food processing

- Electrical & electronics sector

- Adhesives

- Fabrics

- Others

- By application

- Film

- By application

- Chemicals & life science equipment

- Electrical & electronics sector

- Hot melt adhesives

- Composite molding

- Solar panels

- Others

- By application

- Powder

- By application

- Chemical processing

- Cookware

- By application

- Tubes

- By application

- Chemical processing

- Food processing

- Automotive

- Medical

- By application

The above information is provided on a regional and country basis for the following:

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Poland

- Asia Pacific

- Japan

- India

- China

- South Korea

- Indonesia

- Australia

- Latin America (LATAM)

- Brazil

- Argentina

- Middle East & Africa (MEA)

- Saudi Arabia

- UAE

- South Africa