Home > Chemicals & Materials > Textiles > Coated Fabrics Market

Coated Fabrics Market Size, Share and Industry Analysis Report by Product (Polymer Coated Fabrics, Rubber Coated Fabrics, Fabric Backed Wall Coverings), and Application (Transportation, Protective Clothing, Industrial, Furniture) Regional Outlook, Growth Potential, Competitive Market Share & Forecast, 2016 – 2024

- Report ID: GMI764

- Published Date: Sep 2016

- Report Format: PDF

Coated Fabrics Market Size

Global Coated Fabrics Market size surpassed $18 billion in 2015, with estimated gains at over 4% CAGR from 2016 to 2024. Strong application outlook in manufacturing air bags and seat covers in automotive industry coupled with stringent regulatory compliances to give protective clothing to labors are key trending factors driving global market.

Global automobile sales were over 86 million units in 2015. Passenger cars contributed about 63 million units and commercial sales were 20 million units in the same year. Automobile production is projected to surpass 100 million units by 2018. Increasing automotive sales in China, Thailand, India, and Indonesia should stimulate the coated fabrics market share. Consistent aesthetic improvements & scope for seat cover design customization will promote product use as a low-cost alternative to leather.

Global industrial protective clothing spending was over USD 5 billion in 2015, increasing at over 14% CAGR. Agriculture, chemical processing, food processing, law enforcement, medical, and military are major industries using protective clothing where participants must be shielded from chemicals, heat, biological contaminants, or other environmental risks.

Government implementations such as Model Work Health and Safety Act in Australia and European Union’s Directive 89/686/EEC are influencing industries towards industrial protective clothing adoption. Nylon is the most widely used coated fabric substrate over its counterparts such as polyester due to its light weight and amenability to a variety of coatings.

Industry profitability is mainly dependent on the production of end use products such as and competition level from alternative materials including plastic, leather, and uncoated fabrics, and rubber sheeting. Transportation sector majorly influenced the coated fabrics market revenue due to product applicability in motor vehicles, aerospace, and marines.

Presence of many substitute materials including leather & plastics accompanied by toxic residue while manufacturing may threaten industry growth. Comparatively less cost of plastic and having large applicability could impact on the coated fabrics market trend.

| Report Attribute | Details |

|---|---|

| Base Year: | 2015 |

| Coated Fabrics Market Size in 2015: | 18 Billion (USD) |

| Forecast Period: | 2016 to 2024 |

| Forecast Period 2016 to 2024 CAGR: | 4% |

| 2024 Value Projection: | 27.4 Billion (USD) |

| Historical Data for: | 2013 to 2015 |

| No. of Pages: | 143 |

| Tables, Charts & Figures: | 127 |

| Segments covered: | Product, Application and Region |

| Growth Drivers: |

|

| Pitfalls & Challenges: |

|

Coated Fabrics Market Analysis

Polymer coated fabrics segment generated USD 17 billion in business revenue in 2015 and will continue to increase due to surging demand for airbags in automobile and protective clothing in manufacturing companies. China, South Korea, and Germany being the major contributor in automotive and aerospace industry should ease the coated fabrics market.

Rubber fabrics may surpass USD 2 billion revenue by 2024 due to its durability, elasticity, flexibility, and resistance to degradation properties. The product’s major applications include automotive upholstery, storage bags, food conveyor belts, rainwear, boats, lifeboats, gymnasium mats, aprons, truck covers, and protective garments.

Growing demand from the industrial & commercial base and revitalizing construction industry especially in Indonesia, China, Malaysia and India will continue to drive the coated fabrics market growth. Also, increase in public infrastructure spending and rise in consumer interest in home interiors will drive the fabric wall backed covering demand.

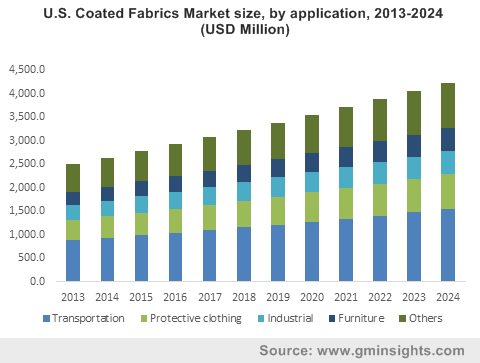

Transportation led the industry application segment and was worth over USD 6 billion in 2015, mainly due to execution of safety standards for automobiles and industrial workers coupling with government initiatives such as National Highway Traffic Safety Administration (NHTSA) to promote safe driving has encouraged product growth. Additionally, increasing application scope in producing insulators on space shuttle for solid rocket nozzles will fuel the coated fabrics market growth.

Protective clothing applications are projected to expand at 4% CAGR through 2024. Standardized safety protective measures implementation for the workers associated with industrial operations and safety packages use in rescue and swimming purposes will drive the protective clothing industry. Aprons, chemical and hazardous material suits, clean room clothing, cut and slash-resistant clothing, gloves, footwear, reflective clothing, and space suits are widely used protective clothing.

Europe, led by UK, France, & Germany generated over USD 3 billion revenue in 2015. Regulatory norms associated to worker’s safety and standardized guidelines to passenger safety are key factors stimulating regional coated fabrics market value.

Rising penetration in transportation and protective clothing applications due to presence of numerous manufacturing companies should drive the coated fabrics market in China. APAC may see over 4% growth rate owing to emerging business in chemical, automotive, and healthcare industries in South Korea, India, and Malaysia.

Endowed with stringent guidance from National Fire Protection Association (NFPA), OSHA, and ASTM, U.S. is a highly legalized industry. Incursions into shale exploration and renewable chemicals commercialization has observed an improvement in the regional protective clothing business.

Presence of large-scale construction projects in Saudi Arabia, Kuwait, and UAE accompanied by regulations of labor security should favor the Middle East & Africa coated fabrics business growth.

Coated Fabrics Market Share

Global coated fabrics industry share is highly fragmented as the industry top six players accounting for over 25% of the global demand. Based on revenue, major industry player includes:

- Omnova Solutions

- Takata Corporation

- Saint-Gobain

- Canadian General Tower

- Trelleborg

Global coated fabrics market report includes in-depth coverage of the industry with estimates & forecast in terms of volume in Tons and revenue in USD million from 2016 to 2024 for the following segments:

Click here to Buy Section of this Report

By Product

- Polymer Coated Fabrics

- Rubber coated fabrics

- Fabric backed wall covering

By Application

- Transportation

- Protective clothing

- Industrial

- Furniture

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Poland

- Russia

- Asia Pacific

- China

- India

- Japan

- South Korea

- Thailand

- Indonesia

- Australia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- UAE

- Saudi Arabia