Home > Healthcare > Drug Device Combination > Drug Filled Devices > Antidiabetics Market

Antidiabetics Market Size By Product (Insulin {Rapid Acting, Long Acting, Premixed Insulin, Short Acting, Intermediate Acting}, Drug Class {Alpha-Glucosidase Inhibitors, Biguanides, Sulphonylureas, GLP-1 Agonist, Meglitinides, DPP-4 Inhibitors, SGLT-2, Thiazolidinedione}), By Patient Population (Pediatric, Adult, Geriatric), By Route of Administration (Insulin Syringe/Insulin Pen, Insulin Pump, Intravenous Infusion, Oral), Industry Analysis Report, Regional Outlook, Application Potential, Price Trends, Competitive Market Share & Forecast, 2020 – 2026

- Report ID: GMI504

- Published Date: Jun 2020

- Report Format: PDF

Antidiabetics Market Size

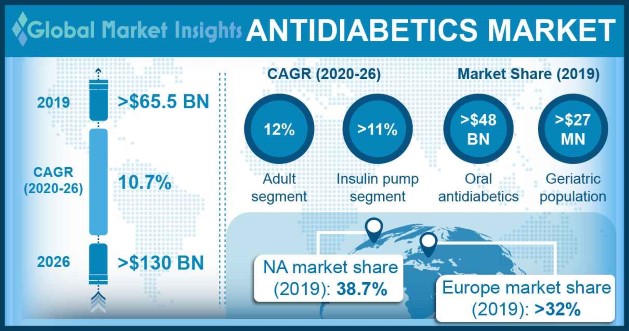

Antidiabetics Market size was USD 65.5 billion in 2019 and will grow at a CAGR of 10.7% from 2020 to 2026.

Increasing prevalence of diabetes across the globe will stimulate the market potential for antidiabetics drugs during forecast period. Need for effective treatment with low side effects will result into increasing R&D spending by pharmaceutical firms for drug development. Thus, escalating demand and adoption of antidiabetic drugs in developing as well as developed nations will boost the market growth in the upcoming period.

| Report Attribute | Details |

|---|---|

| Base Year: | 2019 |

| Antidiabetics Market Size in 2019: | USD 66.7 Billion |

| Forecast Period: | 2020 to 2026 |

| Forecast Period 2020 to 2026 CAGR: | 10.7% |

| 2026 Value Projection: | USD 135.9 Billion |

| Historical Data for: | 2015 to 2019 |

| No. of Pages: | 202 |

| Tables, Charts & Figures: | 276 |

| Segments covered: | Product, Patient population, Route of Administration and Region |

| Growth Drivers: |

|

| Pitfalls & Challenges: |

|

Antidiabetics Market Analysis

According to the European Society of Cardiology, diabetic population is estimated to reach at 628.6 million by 2045. Management of diabetes requires timely intervention and medication throughout the patients lifetime due to lack of curative drugs. Advancement in antidiabetic drugs has resulted into increased success rates and minimized complications.

For instance, various new drugs including dipeptidyl peptidase-4 inhibitors, selective sodium glucose cotransporter 2 inhibitors and unique peroxisome proliferator-activated receptor agonists are in development stages. Introduction of new mechanisms have increased opportunities for combination therapies. Hence, public and organizational efforts to innovate in diabetes drugs space will impel the market size in near future.

However, considerable cost of insulin may limit antidiabetics market growth upto some extent in developing countries.

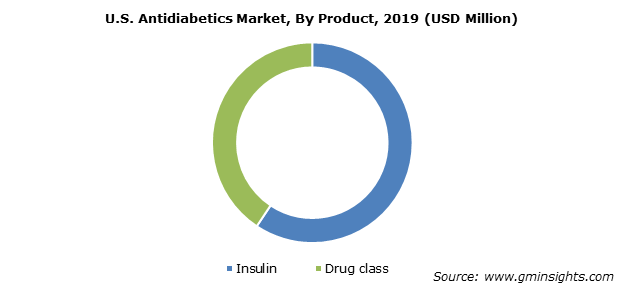

Insulin segment is further segmented as rapid acting analog, long acting analog, premixed insulin, short acting analog, intermediate acting insulin. Drug class is sub classified into alpha glucosidase inhibitors, biguanides, sulphonylureas, GLP-1 (Glucagon like peptide) agonists, DPP-IV (Dipeptidyl Peptidase) inhibitors, Meglitinides, SGLT-II (Sodium Glucose Transport Proteins) inhibitors and thiazolidinedione.

Insulin market constituted significant market share in 2019 and is expected to proceed at lucrative 12.4% CAGR. Introduction of short-acting analog has enhanced its post-prandial glucose-controlling ability in both type 1 and type 2 diabetic patients. Furthermore, with increase in type-2 diabetic patient pool, the segment will witness unprecedented growth during analysis period.

Geriatric population segment held over USD 27 million revenue in 2019. According to the European Society of Cardiology, among the total disease burden approximately 39.7% was due to population growth and ageing. Upsurge in geriatric population has contributed to significant diabetes burden.

With advancing age, prevalence of type 2 diabetes increases along with escalated risk of coronary heart diseases, vascular diseases and stroke. Older diabetes patients are exposed to high risk of sarcopenia and physical disability. Thus, in order to prevent comorbidities coupled with expanding baby boomers globally, the adoption of diabetes drugs in geriatric population will rise in the future.

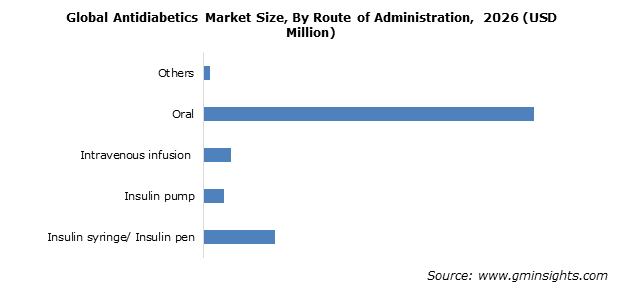

Insulin pump segment is forecasted to progress at over 11% CAGR during the forecast years. Robust growth is primarily attributed to preference for insulin pumps due to its advantages. It offers reduced episodes of severe glycemic conditions with less glucose variability. Also, ability of pumps to store information that can be further analysed and used in treatment planning will boost the segment revenue.

North America constituted 38.7% market share in 2019 and is expected witness robust growth rate in the forthcoming years. According to the American Diabetes Association, approximately 34.2 million Americans were living with diabetes in 2018. About 88 million people had prediabetes in the region.

U.S. antidiabetics market share will grow at 10.3% CAGR during the analysis period. increasing number in pediatric diabetes patients will drive the regional growth. Also, several established drug manufacturers have high penetration in the U.S. antidiabetics industry. Furthermore, increasing need for diabetes management among COVID-19 patients suffering from comorbidities will expand the market demand.

Antidiabetics Market Share

Some of the prominent business players operating in the antidiabetics industry share include:

- AstraZeneca

- Novartis AG

- Johnson & Johnson

- Merck & Co. Inc

- Pfizer

- Sanofi

These market players are adopting various inorganic growth strategies to increase market share and achieve competitive advantage.

Some of the recent industry developments:

- In December 2019, Mankind Pharmaceuticals signed collaborative marketing agreement with Glenmark Pharmaceuticals to market remoglifozin, an antidiabetic drug, in India. This has allowed both the firms to expand their business in Asia Pacific region.

- In February 2018, Cipla collaborated with Novartis and Johnson & Johnson to market their anti-diabetics drugs. This collaboration has led to business expansion of the firm thereby strengthening its market position.

The antidiabetics market research report includes an in-depth coverage of the industry with estimates & forecast in terms of revenue in USD from 2015 to 2026 for the following segments:

Click here to Buy Section of this Report

By Product

- Insulin

- Rapid acting analog

- Long acting analog

- Premixed insulin

- Short acting analog

- Intermediate acting insulin

- Drug class

- Alpha glucosidase inhibitors

- Biguanides

- Sulphonylureas

- GLP-1 (Glucagon like peptide) agonists

- DPP-IV (Dipeptidyl Peptidase) inhibitors

- Meglitinides

- SGLT-II (Sodium Glucose Transport Proteins) inhibitors

- Thiazolidinedione

The above information is provided for the following regions and countries:

North America

- U.S.

- Canada

Europe

- Germany

- UK

- France

- Italy

- Spain

Asia Pacific

- Japan

- China

- India

- Australia

Latin America

- Brazil

- Mexico

Middle East & Africa

- South Africa

- Saudi Arabia